VANCOUVER ISLAND, B.C. – Homeowners across British Columbia can expect to receive their 2019 property assessments in the mail soon.

The assessment notices reflect the market value of properties as of July 1, 2018.

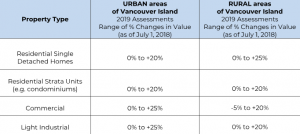

Vancouver Island assessor Tina Ireland said in a release that the majority of residential homeowners could expect an increase up to 20 per cent as compared to last year’s assessment.

“All markets were relatively strong as of July 1 2018, including single family, condominiums, and commercial properties. Increases in assessments are generally lower in the south part of the island and higher as you move to the central or northern areas,” she stated.

The following table shows the Vancouver Island region’s estimated range of percentage changes to 2019 assessment values by property type compared to 2018.

BC Assessment noted that the Island’s total assessments jumped from around $222 billion in 2018 to $246.9 billion this year.

“A total of almost $3.9 billion of the region’s updated assessments is from new construction, subdivisions and rezoning of properties. BC Assessment’s Vancouver Island region includes all communities located within Greater Victoria, South Island, Central Island, North Island, West Coast, Northern and Southern Gulf Islands and Powell River,” read the release from the assessment agency.

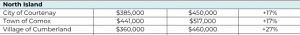

BC Assessment released numbers on the market trends for single-family residential properties by geographic area.

In the city of Courtenay, a single-family residential property was listed at $385,000 in 2018 as compared to $450,000 this year, a 17 per cent increase.

For Comox, the 2018 value was listed at $441,000. This year, that’s at $517,000, which is a 17 per cent increase.

Cumberland was listed at $360,000 (2018) and $460,000 for this year. That’s a jump of 27 per cent.

BC Assessment also provided numbers for strata residential properties (for example: condominiums) for certain areas on the Island.

The City of Courtenay’s assessed 2018 value was $240,400. For this year, it’s been listed at $283,900, an increase of 18 per cent.

Further details can be found through BC Assessment’s website.

“Property owners can find a lot of information on our website including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2018 or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” Ireland said in the release.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by January 31st, for an independent review by a Property Assessment Review Panel.”

The Property Assessment Review Panels are independent of BC Assessment, and are appointed annually by the Ministry of Municipal Affairs and Housing.

The panels typically meet between February 1st and March 15th to hear formal complaints, according to the release.

“It is important to understand that increases in property assessments do not automatically translate into a corresponding increase in property taxes,” explained Ireland.

“How your assessment changes relative to the average change in your community is what may affect your property taxes.”

There are three BC Assessment offices on Vancouver Island. One is in Victoria, with one in Nanaimo and another in Courtenay (2488 Idiens Way).